Modification to the Form 930 of Transfer Pricing

On June 17, 2020, the General Revenue Directorate issued Resolution No. 201-3338, which modifies the declaration form 930 v2.0 corresponding to the Transfer Pricing Report.

This modification is aligned with Article 9 of Law 69 of 2018, which restores the validity of Article 762-L of the Tax Code, which states that economic agents who carry out commercial transactions with related companies established abroad, economic areas, special regimes and/or any other free zone, are subject to the transfer pricing regime. As well as the commercial transactions that may arise between companies established in such economic areas, special regimes and/or free trade zones.

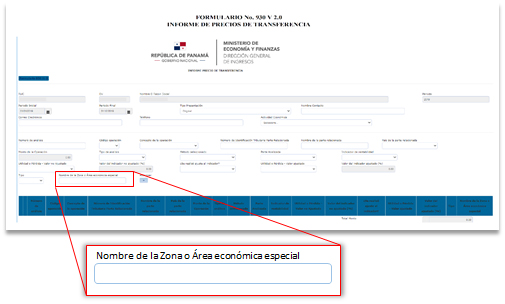

The update of Form 930 corresponds to the inclusion of a drop-down space, in which the type of special economic area in which the related party with which commercial operations were carried out in the fiscal period under analysis is located (if applicable) will be selected. It is important to bear in mind that this modification to the transfer pricing declaration form will be applicable from the period 2019 onwards